Introduction

Last year I-Bonds hit a record rate of 9.62% in May of 2022. While I had avoided I-Bonds in the past, I took advantage of the rate and purchased them for myself, my wife, and my kids, as well as some gift I-Bonds.

Like treasury bonds, you don’t pay federal income taxes on the interest earned on I-Bonds until they’re cashed in. I-Bonds are also not subject to state income taxes. There are some cases where I-Bonds can be tax-free if used for education.

Last week the new I-Bond rate of 5.27% was announced through April 2024, up from the last rate of 4.3% offered in May. This includes a fixed rate of 1.3%. The fixed rate is the highest since 2007, which might make it attractive to some investors. In this newsletter, I’ll explain what I-Bonds are and how they work. I’ll also explain why we’re selling our I-Bonds.

A quick reminder that this is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Please subscribe and help spread the word:

What are I-Bonds?

I series savings are bonds that were created by the government in 1998 that are tied to inflation. The interest rate on the bonds comprises two components - a fixed rate, which remains the same after purchase, and a variable rate, which changes every six months on the first day of May and November based on inflation. Until last November, the fixed rate had stayed at 0% since 2020. However as noted, the new fixed rate effective November 1, 2023, of 1.3% is the highest since 2007. The variable rate is the percentage change in inflation over the past six months based on the Consumer Price Index or CPI. Simply put, when inflation is rising, so is the variable rate, and the variable rate drops as inflation drops.

You can see the formula used to calculate the I Bond rate on the Treasury Direct website here.

Right now the interest rate is 5.27%, however that includes the fixed rate. What that means is if you buy I-Bonds now, you lock in that fixed rate of 1.3% for as long as you own the I-Bond. For people who bought I-Bonds with a 0% fixed rate, you subtract the fixed rate and re-work the calculation. So for the I-Bonds I purchased at 9.62%, the new interest rate is actually 3.94%.

The rate on I Bonds can’t ever fall below 0, so you’ll never lose money as long as you hold on to them for a year.

I-Bonds can be purchased at TreasuryDirect.com.

I-Bond Rules

There are a few caveats with purchasing I Bonds. The first is that you have to hold on to the I Bond for at least one year. Keeping the I Bond for five years guarantees getting all of your money back plus interest. If you cash in the I-Bond between 1-5 years, there is a penalty of 3 months of interest.

The other caveat is that there is a $10,000 purchase limit for an I Bond per person per calendar year. People who use their federal income tax refunds can purchase an additional $5,000, which would bring the annual limit to $15,000.

While there is a $10,000 purchase limit for I-Bonds per calendar year, your partner can also purchase them, and you can also purchase I-Bonds for your children. You can’t open a joint account, so my wife and I had to create separate accounts. However, you can purchase I-Bonds for children in your own account, which I did for my two daughters.

Regarding the $10,000 limit, there are ways to purchase more I Bonds for a business or any number of trusts, but I’m not going to get into that since I personally did not do that.

There is also a loophole with gifting I Bonds, which I did do last year. With gifting I Bonds, you can only deliver up to $10,000 per year to a recipient assuming they didn’t purchase any I Bonds themselves that year. More details on gifting I Bonds can be found on the Treasury Direct website.

So what my wife and I did last year is we bought each other $30,000 in I-Bond gifts, in addition to the I-Bonds we purchased last year. This year we gifted each other $10,000 in I-Bonds, and plan to do the same in 2024 and 2025, assuming we don’t buy more I-Bonds. The gift I-Bonds also earn the current rate, so you would start earning 5.27% if you purchased them today.

How To Purchase I-Bonds

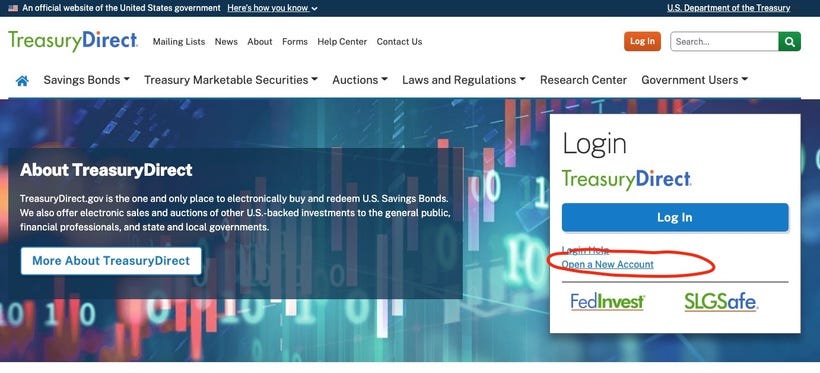

There is one more caveat with I-Bonds, which is that you can’t purchase them through a broker. To purchase I-Bonds, go to TreasuryDirect.gov and click on Open An Account.

You will be emailed an account number, make sure to save that because that’s what you use to log in. From there you fill out the registration form.

Timing The Purchase Of I-Bonds

As noted, the I-Bond rate changes every six months on the first day of May and November. Whenever you purchase the I-Bond, you are guaranteed that rate for six months. So if you were to purchase the I-Bond at the current rate of 5.27%, you get that rate for six months as long as you purchase it before May 1st. So for instance, if you purchased an I-Bond today, you would get the 5.27% rate until May 1st, when you get the new rate, whatever it may be at that time. If you bought the I-Bond in April, you would have the 5.27% rate until October 1st, and then you would get the next rate (that was set months earlier on May 1st) for six months, then the next rate for six months, and so on.

However, the issue date of the I-Bond is the first day of whatever month you make the purchase. So for instance, if you purchase an I-Bond on November 3rd, or if you purchase it on November 28th, the issue date in either case is November 1st and that counts as the first of the six months at the current rate. However, by purchasing the I-Bond on November 28th, you miss 28 days of interest for that month. So it’s best to purchase the I-Bond as early in the month as possible.

Our I-Bond Performance

The first I-Bond I purchased was in July of 2022 at the 9.62% rate. From there, we also purchased I-Bonds and gift I-Bonds through October of 2022 at that 9.62% rate.

Just looking at the first I-Bond I purchased, it has been 16 months so I can now redeem it, although I will have to forfeit three months of interest. Up until now, the I-Bond has averaged 6.9% (6 months at 9.62%, 6 months at 6.48%, and the remaining 4 months at 3.38%). I’ll have 2 more months at 3.38% before the interest rate goes up to 3.94%.

As for what’s next, I am planning to start selling our I-Bonds. As noted, the first I-Bond I purchased averaged 6.9%. If I redeem it now, if you take into account the 3 months of interest I’ll forfeit, that rate drops to 6.25%, which is still good, but it will continue to drop each month as the interest rate for the next 8 months will be under 4% (3.38% for 2 months, and then 3.94% for the following 6 months). I can get a better return by buying a treasury bond or a CD. So for me, the best decision is to sell all the I-Bonds we can (we can’t sell all the gift bonds yet) since there are better returns elsewhere.

Conclusion

I-bonds can be a little confusing, so feel free to contact me on Twitter or leave a Comment below with any questions you may have. Please let me know your thoughts on this newsletter and submit any feedback. You can follow me on Twitter at @TheRajGiri or on Threads at @RealRajGiri . If you haven’t already, please subscribe below: