Revealing My Stock Portfolio

Listing the individual stocks I own in my after-tax account.

Introduction

Investing in individual stocks has something I usually don’t recommend to people because in general, there is a terrible track record for it. Even with expert investors, after 10 years, 85% of large-cap actively managed funds underperformed the S&P 500. After 15 years, that number rose to 92% underperforming the S&P 500. Because of that, I always recommend investing in a low-cost index fund. The vast majority of my investments are in low-cost index funds like FXAIX (an index fund from Fidelity that tracks the S&P 500) and ETFs like VOO (which also tracks the S&P 500), VTI (which tracks the U.S. total market) and QQQ (which tracks the Nasdaq).

However, I do also invest in stocks and have been lucky to have success with it, mostly due to buying into a handful of tech stocks at good times.

I first toyed with the stock market in the late 90s. I was invested in some mutual funds that were doing great, and figured I had the Midas touch so I decided to just start buying penny stocks. I figured if just a few of them hit, I’d be rich. None of them did. I think I started with about $3500. Months later, I was down to about $250. I just sold it and figured that investing in stocks wasn’t for me.

In 2005, Apple introduced the iPod video and the stock took a big hit. I didn’t get it, since I thought it was the future so I decided to get back in and buy Apple stock. And just like that, I was back in the market.

For a while, I would just buy a lot of stocks, but over time, I noticed that I was trailing the S&P 500. So then I decided to trim the fat and just keep my portfolio to 10-15 stocks at the most and focus on companies that I really believed in.

I keep separate brokerage accounts for stocks, retirement, ETF investing (which focuses on dividends but also has funds like VOO and QQQ), fixed income (bonds and CDs), etc. I’ll go through all those in future posts. In this post, I’ll list the positions in my taxable brokerage account at Charles Schwab that focus on stocks.

A quick reminder that this is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments.

Please subscribe and help spread the word:

My Stock Holdings

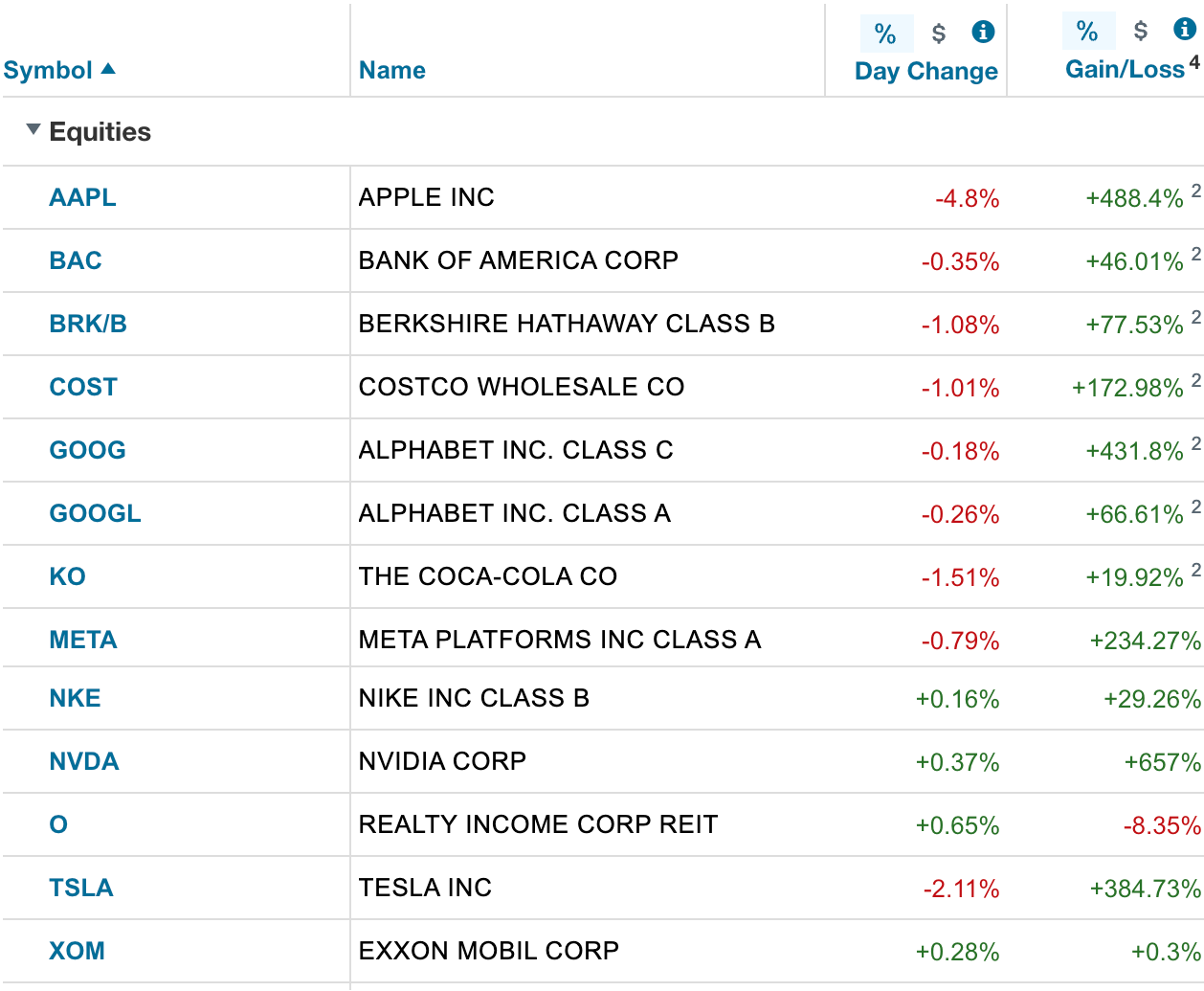

I currently own 12 stocks (technically 13 since I own Google Class A and Class C shares, which automatically happened when their stock split in 2014). They are listed below, and the gain / loss for each is through Friday, August 4th, 2023:

Here is how much of my account is invested in each: BRK/B (19%), AAPL (17%), NVDA (16%), TSLA (14%), COST (7%), META (5%), GOOGL (4%), BAC (4%), KO (3.5%), O (2.7%), GOOG (2.5%), XOM (2.4%) and NKE (1%).

In all of my investment accounts, whether it’s an IRA or 529, I have an index fund that I buy into any time I trade. I treat Berkshire Hathaway (BRK/B) like an index fund in this account, and whenever I buy anything, I make sure to buy more BRK/B as well.

I stopped trying to time the market a long time ago, so I buy stocks that I plan to hold on to and keep adding to. In most of my accounts, I dollar-cost-average and invest automatically each week, however for this account, I just try to make sure to buy at least a couple of times a month, usually during bad weeks where the S&P 500 drops 2% or more. If one of the companies I own has a bad week, I’ll usually buy more of that stock, depending on the news.

So I only have one loser?

Obviously, I have had my share of losing stocks over the years. At the end of each year I tax-loss harvest, which is a strategy where you sell securities at a loss to offset taxes resulting from a capital gain. There are rules to it which I’ll cover in a future post, but basically, at the end of the year I’ll sell stocks that I don’t think are worth it, and immediately use that money to buy other securities. I make sure to immediately buy so that money is staying invested. Last year I sold Zoom (ZM), Square (SQ), Rivian (RIVN), Palantir (PLTR) and NIO. I’m kinda regretting selling Palantir and NIO. I used the money from that sale to add Exxon (XOM) and Realty Income (O) to my portfolio due to their dividend, as well as to buy more shares of NVIDIA, META, Tesla, BRK/B, and Bank of America (BAC).

Conclusion

Overall, investing in stocks can be great, but more often than not, most people are better off investing in a low-cost index fund. Warren Buffet, generally regarded as the greatest investor of all time, made a bet in 2007 to the hedge fund industry that an S&P 500 index fund would outperform the hedge funds over a 10-year period. Buffet won the bet and donated the winnings to Girls Inc. of Omaha.

In the next issue, I’ll discuss IRAs (what they are and how they work), as well as step-by-step instructions on how to open one. Please let me know your thoughts on this newsletter and submit any feedback. You can follow me on Twitter at @TheRajGiri or on Threads at @RealRajGiri . If you haven’t already, please subscribe below: