This Newsletter's VOO ETF Cracks 100K, When Will It Hit $1 Million?

An update on this newsletter's VOO investment

Introduction

The S&P 500 and Dow closed at a record high last week after the Fed announced that they are cutting rates by 50 basis points. On Thursday, the S&P 500 rose 2.5% to close at 5,713.64. The S&P 500 had a small dip on Friday while the Dow added another 38.17 points, or 0.09%, to close at 42,063.36. Remember last year when I was talking about 4,800 being a good benchmark to use when investing when the market is falling? The S&P 500 was at 4,264 the day that the newsletter went out, so it’s up 34% from that day.

With that, our VOO investment for this newsletter is close to a new high, so I thought it would be a good time to give an update. I also go into more detail below about why I often recommend investing in an S&P index fund to friends and family, depending on their investment goals.

A quick reminder that this is not financial advice, just myself sharing my strategies, investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you found this newsletter helpful, please share it with one friend who might find it useful by using the button below.

VOO Investment Recap

For newer subscribers of this newsletter, here’s a recap of the VOO investment I’ve been making for this newsletter.

When I started the idea of this newsletter in 2022, I thought it would be a good idea to give a real-world example of what automatically investing in an S&P 500 index fund can do. The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the U.S. These companies span across multiple sectors, from technology to healthcare, finance, and energy. Think of big names like Apple, Microsoft, Amazon, and Johnson & Johnson. Together, they represent a significant portion of the U.S. economy, making the S&P 500 a strong indicator of overall market health.

There are so many finance YouTube channels and newsletters telling you how much you could have made if you started investing in the market X years ago, so I thought it would be cool to do a real example for the newsletter since I’ve been doing it for decades in my other accounts with great success. So specifically for this newsletter, I decided to buy and dollar-cost-average (dollar-cost-averaging is explained in this newsletter) into the Vanguard S&P 500 ETF (VOO) which tracks the S&P 500.

The market was in turmoil in the summer of 2022. When I made the initial $5000 VOO purchase on June 16, 2022, the S&P 500 was down 24% for the year. Since then, I automatically bought more shares weekly, originally $500 / week before upping it to $750 / week on May 11, 2023. I also re-invest the dividends. I don’t make any withdrawals or additional investments into it. You can read more about the details of the VOO investment here.

VOO Hits 100K

It’s been 2 1/4 years since the initial investment and it recently crossed $100,000. With the market gains last week, the VOO investment is up 28%. The cost basis total (including dividends) is $82,249.98, with the current value sitting at $105,059.94, a $22,809.96 gain so far.

When Will It Hit A Million?

Historically, the S&P 500 has delivered an average annual return of about 10% before adjusting for inflation. It should be noted that this is an average over many decades. The actual return in any given year can vary significantly. For example, some years see double-digit growth, while others experience negative returns, especially during market corrections or recessions. Despite this volatility, the long-term trend has been upward.

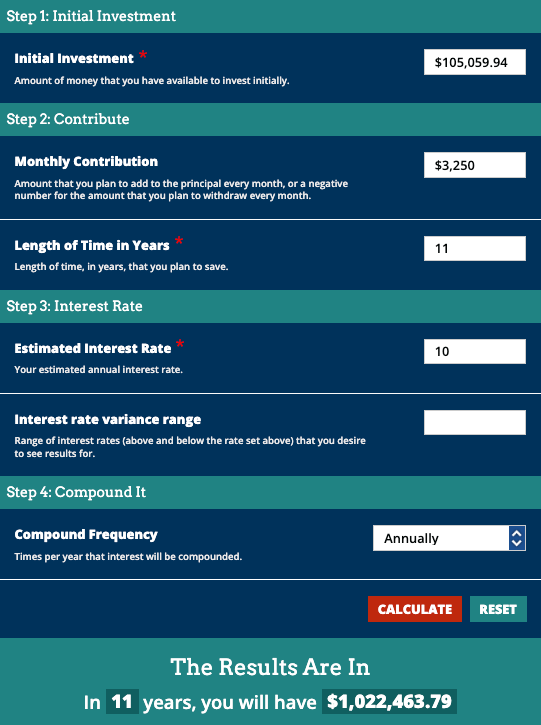

So using the Compound Interest Calculator at Investor.gov, starting with the current value of $105,059.94, assuming a 10% average annual return, and keeping our investments at $750 / week (which averages to $3250 / month factoring in 52 weeks), this investment will be $1,022,463.79 after 11 years.

As always, it’s important to remember that past performance is not indicative of future results, and there will be years with positive returns and years with negative returns.

Why Invest In An S&P 500 Index Fund

VOO is just one of many ETFs that track the S&P 500, with some others including SPDR S&P 500 ETF Trust (SPY) and iShares Core S&P 500 ETF (IVV). There are also great index funds that track the S&P 500 like Fidelity 500 Index Fund (FXAIX, which I invest in), Vanguard 500 Index Fund Admiral Shares (VFIAX) and the Schwab S&P 500 Index Fund (SWPPX). When I choose an index fund, I look at the following:

Expense Ratio: I try to look for funds with low expense ratios.

Tax Efficiency: I prefer tax-efficient funds like ETFs, that minimize capital gains taxes.

Tracking Error: I look at the short-term and long-term returns and make sure that the fund closely tracks the S&P 500 index.

While I often recommend S&P 500 ETFs and index funds to some friends and family, it’s not something I blindly recommend to everyone as it depends on a person’s investment objectives. Below are some of the reasons why a good portion of my portfolio is dollar-cost-averaging in S&P 500 ETFs and index funds:

Diversification: By investing in an S&P 500 index fund, I’m automatically investing in a wide range of companies across various industries. This helps to mitigate risk.

Low Costs: Index funds typically have lower expense ratios compared to actively managed funds, meaning more of the investment goes towards buying stocks.

Historical Performance: Over the long term, the S&P 500 has generally outperformed most actively managed funds.

Ease of Use: Investing in an S&P 500 ETF is straightforward. You can buy and sell shares just like any other stock.

Conclusion

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: