Practical Money: The Best Credit Cards For 2024 Returning 2-5%

Getting the most from your credit cards.

Introduction

A belated Happy New Year to everyone! My apologies for not posting a newsletter in a while, things are usually a little crazy this time of year. But with my kids back in school, I’m finally getting back into my routine and should have an issue every week.

In one of the first issues of this newsletter, I discussed how much I hate credit card debt. In that newsletter, I discussed how I get out of debt coming out of college, as well as other strategies to get out of credit card debt, which you can read here.

Below are the credit cards I use regularly, which return a minimum of 2% cashback, up to 5% with most having no annual fee. A quick reminder that this is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Please subscribe and help spread the word:

First Steps When I Get A Credit Card

I don’t have any credit card debt, all the credit cards I have automatically have the total due paid off each month so I never pay any interest. But if having a credit card makes you more inclined to spend more, it’s best to use cash or a debit card.

The first thing I do when I get a new credit card is to set up the autopay to pay the full balance every month so no interest is ever incurred.

Another thing I do with my credit cards is that I have a Google doc where I list the various benefits associated with each. For instance, some cards offer rental car insurance, so you don’t need to purchase that. Some have foreign transaction fees, while others don’t. It’s easy to forget the various benefits that come with each card, and having a single document makes it easy to keep track.

General Credit Cards I Use

Below are the credit cards I use regularly, and the reason for each. With these, I receive 2-5% cashback or rewards that I wouldn’t have received if I had used checks or a credit card. The cards below have no annual fee except for the Capital One Savor card, which does have a version with no fee.

Amazon Prime Visa (5% back on Amazon.com and Whole Foods purchases)

This one gets a lot of usage. I have two daughters, and we shop at Amazon a lot, probably more than we should. Also, my wife is a health wiz so our main grocery store is Whole Foods, which isn’t cheap. So we have the Amazon Prime Rewards Visa Signature Card, which pays 5% cash back for purchases on Amazon and Whole Foods.

On Amazon, we have the card saved in our account while for Whole Foods, we have the Amazon card on our Apple Watch that they accept, so we never have to carry it around. It also offers 2% back at restaurants and gas stations and 1% back on all other purchases, however, we use the cards below for those purposes.

You can get more information at this link.Target RedCard (5% back for purchases at Target & Target.com)

For everyday items that we don’t buy at Amazon, we shop at Target. Our daughters are also big Target connoisseurs. Like with Amazon, with the Target RedCard, you receive 5% back at Target and Target.com.

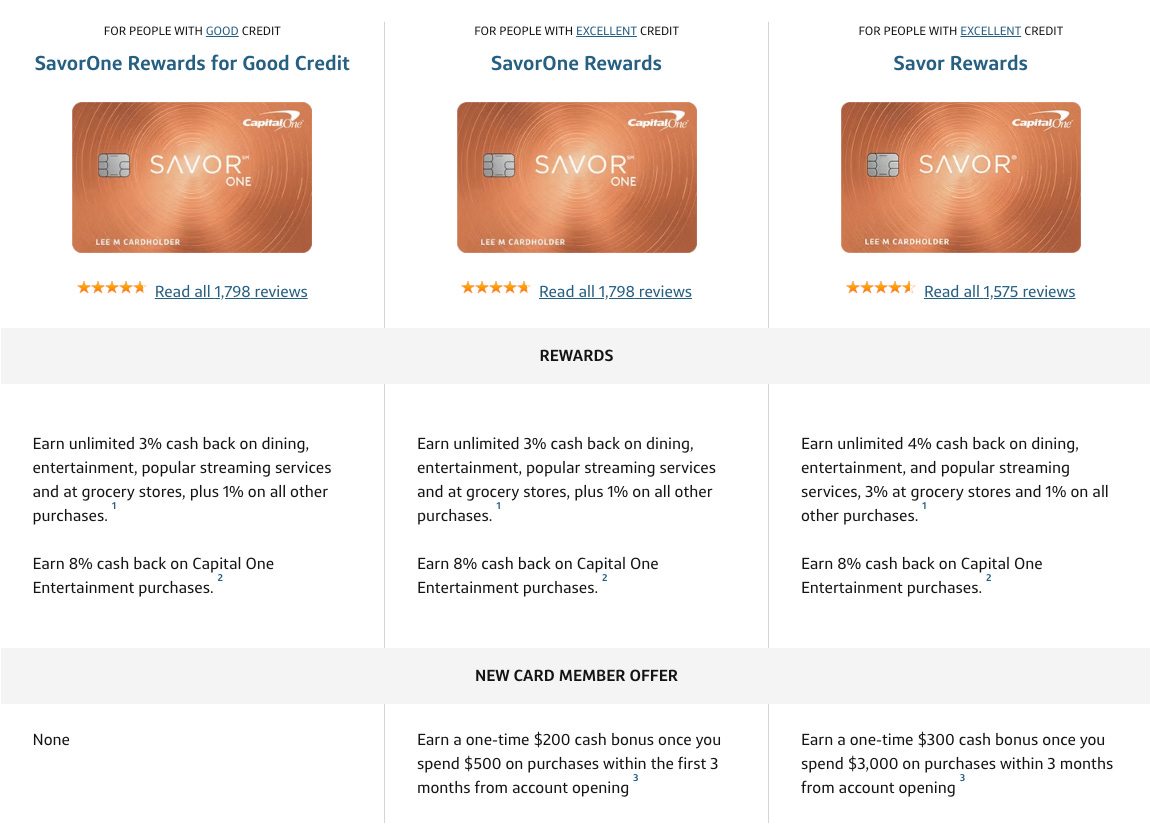

More details are available here.Capital One Savor Rewards (4% back on dining, entertainment and streaming services, 3% at grocery stores, 10% on Uber. $95 annual fee, or get the SavorOne Rewards with no annual fee).

This is the only card where we pay an annual fee, however, it is the one that gets used a lot. This is also one of the two credit cards that we actually carry around. We eat out a lot, so this pays for itself pretty quickly. For dining, you receive 4% back for restaurants, cafes, fast food, etc. We also use the card for all grocery shopping not done at Whole Foods (we use the Amazon Prime Visa for that which has 5% back) and it is saved on our phones for Uber (10% back).

We also auto-pay our streaming services with this card (4% back). This works for almost all streaming services, including Netflix, Apple, Max, Hulu, DirectTV, Spotify, etc. Streaming services that do not qualify for cash back include Amazon Prime Video, AT&T TV, audiobook subscription services, and fitness programming. Finally, we use this card for entertainment purchases (4% back) which include movie tickets, pro sporting events, amusement parks, zoos, bowling alleys, live theater tickets, and more.

There are no foreign transaction fees, so we use this card for all dining and grocery purchases when we travel as well.

There is also the Capital One SaveOne Rewards card that has no annual fee, however, it offers 3% back instead of 4% for dining, streaming services and entertainment.

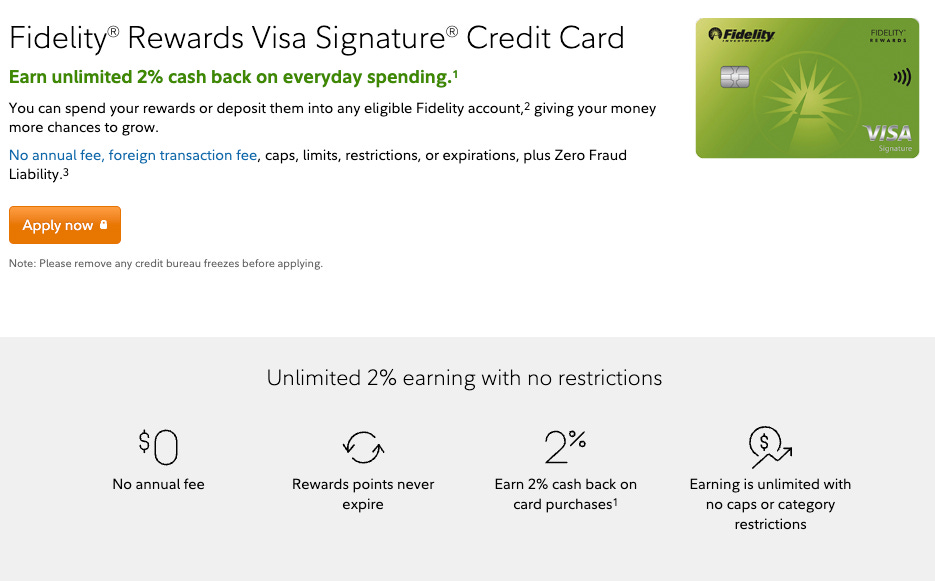

You can get more information about this card by clicking here.Fidelity Rewards Visa Signature Credit Card (2% - 3% on everything)

We use this card for all of our other automatic payments that aren’t made by the credit cards above (things like gym memberships, cell phone bills, insurance, our daughters’ dance classes, etc.). Because we use this card for so many automatic monthly bills, we do not carry it around because if it got lost, it would be a huge pain. We do have it saved in our browsers via Google Wallet (for online purchases), and on our watches/phones using Apple Pay (for places that accept Apple Pay including Costco, gas stations, etc.).

With the type of Fidelity account we have, we receive 2.25% cash back. With the rewards from this card, you can spend them or deposit them into any eligible Fidelity account, such as a brokerage account, Cash Management Account, or a 529 college savings plan. We have the cash back automatically deposited into our Fidelity Checking account every month.

The card also has no foreign transaction fees, so we use this when we travel via Apple Pay. You can get more information about this card here.Citi Double Cash Card (2% cash back on everything, our fallback card).

This is the second card that we carry, along with our Capital One Savor Rewards card. It offers 2% cash back, but there’s a quirk. You get 1% cash back when you make a purchase, then another 1% cash back when you pay it off. But since I pay my balance in full every month, it’s 2% back.

With 2% cash back, it is the worst-performing of the cards mentioned so far, so this is essentially our fallback card. So for example with my barber, I would normally try to use our Fidelity card via Apple Pay. However, they are not set up for Apple Pay, so I use this card.

This card does have a 3% foreign transaction fee, and foreign currency purchases do not count for rewards. Because of this, we do not use this card when we travel.

You can get more details on this card here.SoFi Credit Card (2% cash back, used for travel)

We use this credit card for airline tickets and hotel accommodations, and it is also our fallback for purchases on vacations. There are no foreign transaction fees. Unlike the cards above, this is paid automatically from our high-yield savings account, which we use for travel expenses. So we carry this with us on trips and use it when the other cards above don’t apply.

Travel Cards

You’ll notice that we do not use travel rewards cards. Many airline rewards cards come with an annual fee, however, they offer perks like free checked bags, access to their lounges, and statement credits for food and beverage purchases on board. Since I don’t travel as often as I used to, and I usually carry on my bags, they haven’t been worth it for me.

For instance, with the United Explorer MileagePlus card, NerdWallet estimates that United miles are worth about 1.2 cents each. You receive 2X miles when purchasing United flights using the United card, so essentially you’re getting back 2.4%, as opposed to the 2% I’m receiving with the SoFi card we use for travel. With the $95 annual fee with the United card, I would have to spend over $20,015 with the United card for it to have an advantage over the SoFi card. You do receive nice perks when you first apply for many of these cards like bonus miles, and I have signed up for United and Hyatt cards in the past and canceled before the 1-year mark came up.

Conclusion

There are other store cards that we use here and there, like the Best Buy card (5% back in rewards), Macy’s, etc. But the vast majority of the cards we use are the ones mentioned above. Once again, it is important to not carry credit card debt, otherwise the benefits mentioned above are all for naught. Receiving 5% back is great and all, but it’s nothing compared to the 20-35% many cards charge in interest if you carry a balance.

That's it for this week! If you found this newsletter helpful, please share it with one friend who might find it useful by using the button below:

As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Please let me know your thoughts on this newsletter by leaving a comment using the button below:

If you haven’t already, please subscribe below: