Practical Money: Revising My "4800 Strategy", How To Buy An S&P 500 Index Fund, VOO Update

A dive into investing in an S&P 500 index fund.

Introduction

Last October, I explained my “4800 strategy”, which you can read here. In a nutshell, I set an S&P benchmark and anytime I buy into an S&P 500 index fund under that benchmark, it’s basically on sale. A lot has changed since then, which I’ll discuss below.

Also, thanks for the feedback on this newsletter. One thing I wanted to do was make this simplified enough so that it’s something that people of all ages can use. Recently, I’ve gotten people asking just how to get started investing in an S&P 500 index fund. Hearing “just dollar-cost average into an S&P 500 index fund” is great and all, but how do you actually do that? I’ll go through it step-by-step below.

A quick reminder that this is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Please subscribe and help spread the word:

The S&P 500 Crosses 4800… And Then Some. The new benchmark.

When I wrote the newsletter about my 4800 strategy last October, the market was in a bit of a slump after being red hot for most of the year. At that time, the S&P 500 was at 4,264, so using 4,800 as a benchmark (which would be an all-time closing high), I was buying the index at a 13% discount (the difference between 4,264 and 4,800).

A lot has happened since then. The S&P crossed 4,800 on January 19th and kept going. It crossed 5,000 earlier this month and closed at an all-time high of 5008.806 on Friday. So it’s time for a new benchmark!

The official S&P 500 benchmarks used to be every 100, so 100, 200, etc. Once it hit 1000, it became every thousand, so 1000, 2000, etc. But every time it’s raised, the percentage to hit the next benchmark is less. For instance, to go from 1000 to 2000 is a 100% increase. But to go from 4000 (which the S&P 500 first crossed on April 1, 2021) to 5000 (which it crossed on February 9th) took under 3 years.

I’m setting my S&P 500 benchmark to 6000, which would be 20% from the 5000 range it’s currently at. So my “4800” strategy is now my “6000” strategy. If we have a bullish market like last year, it could very well happen this year. If it’s a bearish market, then it could take years. But I’m pretty sure it will happen eventually (if it never happens, then there are much bigger things to worry about).

VOO Update

Last October, I discussed dollar-cost averaging and how I utilize it (you can read it here.) I also put that strategy to the test for the purpose of this newsletter (which originally was supposed to be a YouTube channel). In the summer of 2022, I bought the Vanguard S&P 500 ETF (VOO) which tracks the S&P 500, and have been automatically investing in it every week. You can read the details on how much I initially invested and how much I’m adding every week here.

Here is an updated look at how it’s performing 20 months after the initial investment on June 16th, 2002. As seen in the chart below, it has returned about 21% and is up $12,396.50, bringing the total value to $71,981.82, which includes $797.22 in dividends which were automatically reinvested.

These returns are higher than the norm because last year was a hot year, and this year has been on fire so far as well. Over the last 30 years, the average yearly return for the S&P 500 has been about 10%.

How To Invest In An S&P 500 Index Fund

The one thing I wanted to accomplish for this newsletter was for it to be informative for both novice and intermediate investors. One question I’ve received several times when discussing investing in an S&P 500 index fund is, “How exactly do I do that?” So I’m going to use this space to go step by step on how I purchase an S&P 500 index fund. I’ll do more step-by-step in the weeks ahead, including buying ETFs and stocks, contributing to an IRA, contributing to a 529 plan, and more.

For this example of how to purchase an S&P 500 index fund, I’ll be using my Fidelity account. Just a reminder that this is not investment advice, this is just how I manually purchase index funds through Fidelity.

The first step is to open an account with Fidelity if you do not already have one. You can see the various types of accounts available on this page. In this case, I’ll be contributing to my taxable brokerage account, which would be the “Brokerage Account - The Fidelity Account”:

Once your account is open, you will want to log in and verify that all of the information is correct.

Fidelity’s S&P 500 index fund is called the Fidelity 500 Index Fund, ticker symbol FXAIX. For the most part, my investments in this fund are automatic. To purchase this fund, I click on the “Trade” in the top left corner of the screen:

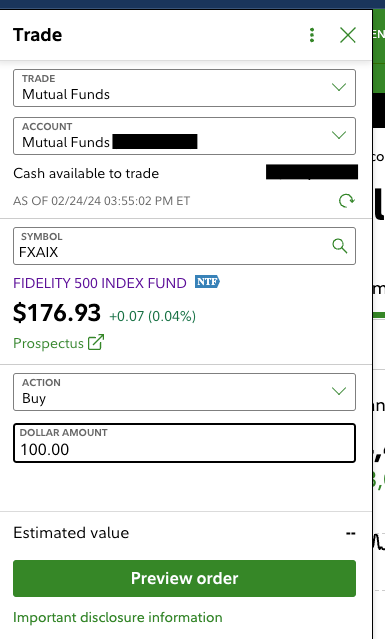

After clicking on “Trade”, I get the Trade dialog window. In the “Trade” dropdown I select “Mutual Funds”, and in the “Account” dropdown I select the appropriate account, in this case, my “Mutual Funds” account. I want to buy $100 worth, so I select “Buy” in the “Action” dropdown and enter $100 for the dollar amount. After everything is entered in, like in the screenshot below, I click “Preview order.”

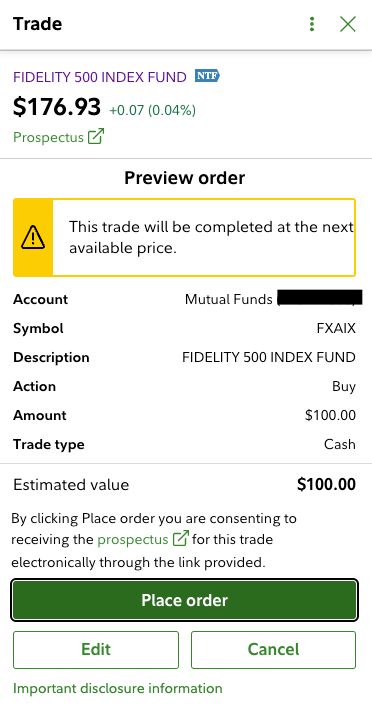

After that, I preview my order and verify that everything is OK. In this case everything looks good, so I click on “Place Order.”

And that’s it! You get a confirmation screen and you’re done!

Conclusion

Whether it’s investing in a 401K account, an IRA account or my taxable investment accounts, investing in an S&P 500 index fund or ETF has been the foundation of them all. The hardest part is making the first investment, and then making a habit of it.

That's it for this week! If you found this newsletter helpful, please share it with one friend who might find it useful by using the button below:

As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Please let me know your thoughts on this newsletter by leaving a comment using the button below:

If you haven’t already, please subscribe below:

Hey Raj. Do you prefer S&P or individual stocks? I make some trades based in interest. For example yesterday I bought shares of MSFT. I'm considering CMG, NVDA and SMH. I know a few of these are in S&P. However I have a preference for individual stocks.