Practical Money: Investing When The Stock Market Is Crashing, VOO Update

How I handle investing during volatile times

Introduction

The last few weeks have been tough for the market. After the big sell-off on Friday, the Nasdaq Composite Index is 10% off of its high set last month, while the S&P 500 ended Friday down 5.7% off of its all-time high.

And then there was today. Global stock markets plunged. The S&P 500 dropped 3% for its worst day in nearly two years while the Nasdaq composite plunged 3.4%.

I had a completely different newsletter scheduled for today, however, I put that on the backburner given the market turmoil the last few weeks. In this newsletter, I’ll discuss how I deal with investing when the market is in a downturn. Also, I thought it might be a good time to give a VOO update.

A quick reminder that this is not financial advice, just myself sharing my strategies, investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you found this newsletter helpful, please share it with one friend who might find it useful by using the button below.

What the hell happened?

The primary culprit for the market downturn last week was a weaker-than-expected jobs report, which raised concerns about the overall health of the economy. Job growth in July in the U.S. slowed more than expected, while the unemployment rate rose to 4.3%, the highest since October 2021. Many tech companies like Amazon reported disappointing earnings, adding pressure to the market. A possible recession is once again being taken seriously by many investors.

And then there was today. It started with Japan’s Nikkei 225 dropping 12.4% making it its worst day since the Black Monday crash of 1987. Fears worsened about the U.S. economy slowing faster than expected. And so on…

The Nasdaq is in correction territory, which means it fell by more than 10% of its record high but less than 20%. It is now down 13% from its peak on July 10th. The S&P 500 is down 9% from its peak. While these price swings can be unsettling, it’s important to remember that volatility is a natural part of market behavior.

How I’m handling the sell-off

You've heard it before: "Buy low, sell high." In general, I ignore that since it is a form of trying to time the market, which very few people ever do successfully. And when stock prices do drop like we’re seeing now, many people freak out thinking that the worst is still to come, and don’t buy anyway. Even worse, many people lose money with their investments because they do what they’re not supposed to: they buy high and sell low.

As I’ve noted before, I invest automatically in most of my accounts (retirement, ETF, etc.) However, I manually invest with my stocks, and I try to add to my positions a couple of times per month. I’ll provide an updated list of the stocks I own in my upcoming newsletter which will be out next week.

As for how I’m handling this sell-off, I see it as an opportunity to add extra to my positions (you can see my holdings as of last year here). I’m waiting a day or two to see if things settle, and then I plan to buy more shares of all my stocks except for Tesla (which I’m holding). I auto-invest in my ETF portfolio every Thursday (you can see my ETF portfolio at this link), but I might add an extra investment into each of my ETFs before then (other than VOO since that’s an example for this newsletter and I don’t want to add extra investments outside of the weekly ones).

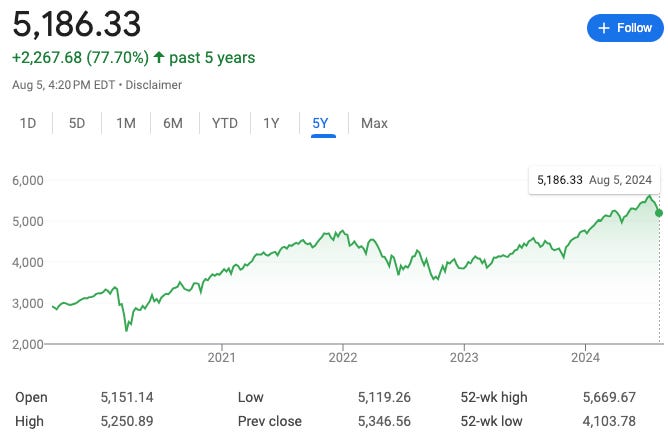

I’ve written this before: By leaving my money in the market when there’s a big dip, I have a chance to earn all its value back and more when the market goes back up. So far the market has always bounced back. But if I sell, I have permanently taken those losses. There have always been ups and downs in the market, and the key has been to be patient. Just as a reminder, this is what the S&P 500 has looked like over the past 5 years.

VOO Update

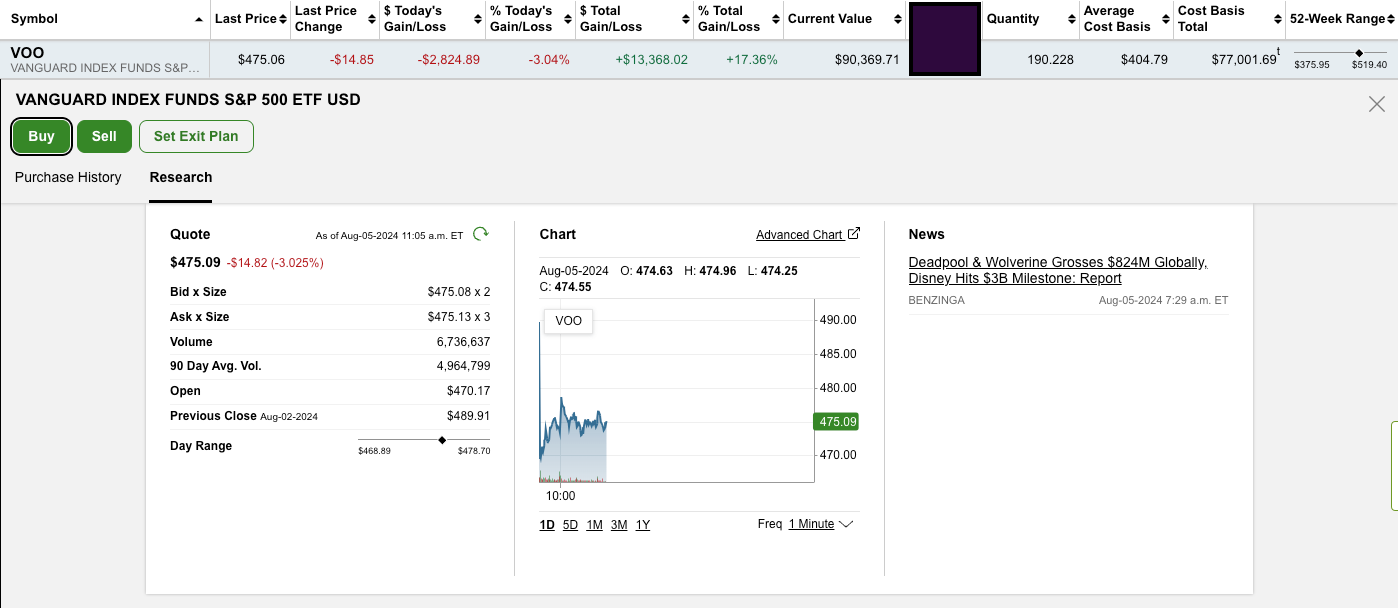

When I started the idea of this newsletter in 2022, I thought it would be a good idea to give a real-world example of what automatically investing in an S&P 500 index fund can do. There are so many finance YouTube channels and newsletters telling you how much you could have made if you started investing in the market X years ago, so I thought it would be cool to do a real example for the newsletter since I’ve been doing it for decades in my other accounts with great success. I decided to buy and dollar-cost-average (dollar-cost-averaging is explained in this newsletter) into the Vanguard S&P 500 ETF (VOO) which tracks the S&P 500.

Like now, the market was in turmoil in the summer of 2022. When I made the initial $5000 VOO purchase on June 16, 2022, the S&P 500 was down 24% for the year. Since then, I automatically bought more shares weekly, originally $500 / week before upping it to $750 / week on May 11, 2023. I also re-invest the dividends. You can read more about the details of the VOO investment here.

It’s been a little over two years since the initial investment. With the 3% drop in the S&P 500 today and the 6% drop over the past month, VOO is up 17.4%. The cost basis total (including dividends) is $77,001.69, the current value is sitting at $90,369.71, a $13,368.02 gain so far.

Conclusion

So many people were getting out of the market when the sky was falling in 2008. Now I think a lot of investors wish they had invested more that year. The S&P 500 today is up 594% from the low of 2008. So in a nutshell, I don’t worry about the ups and downs of the market, I just stay consistent and keep investing.

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: