Practical Money: Dabbling in Bitcoin?, My Updated ETF Portfolio

An updated look at my ETF Portfolio for passive income

Introduction

I generally steer clear of investments that I haven't thoroughly grasped. Cryptocurrency fit that bill for me, it is the financial world's equivalent of a rollercoaster ride at a sketchy carnival. It's thrilling, terrifying, and might leave you nauseous.

I eventually caved in by investing in the Bitwise HOLD 10 Private Index Fund back in 2017. It performed well, and I got out of it completely in 2022. Fast forward to 2024, and guess who's back for more? Me, dipping my toe back in the crypto pool with a Bitcoin ETF. Think of it as training wheels for the wild ride of actual cryptocurrency ownership.

In this newsletter, I discuss why I’m back in the Bitcoin space, and I’ll share my updated ETF / Index Fund portfolio, which has changed a little since I first shared it last September.

A quick reminder that this is not financial advice, just myself sharing my strategies, investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you found this newsletter helpful, please share it with one friend who might find it useful by using the button below.

Background

First off, I’ve gotta say that investing in cryptocurrency is something I NEVER recommend to others. Not many people can handle the swings. I’ve always felt that crypto is one of those areas where people need to really understand how it works and gauge their own risk tolerance before deciding to put any money into it.

I had been studying cryptocurrency for a while and finally decided to take the plunge in 2017 by investing in the Bitwise HOLD 10 Private Index Fund, as well as buying some Ethereum. In 2020, the Bitwise 10 Crypto Index Fund started public trading with ticker BITW on OTCQX. It had appreciated considerably by then, so I sold the majority of my shares, leaving just a little for good measure. In 2022, while doing my tax loss harvesting, I sold the rest, as well as my Ethereum, and happily exited the crypto space.

This past January, Bitcoin ETFs were approved which offered a way for investors to get involved in the price movements of Bitcoin without actually owning the cryptocurrency itself. They work similarly to other ETFs that track a basket of assets or an index. In general, I allocate a small percentage of my portfolio to riskier investments, and with Bitcoin ETFs being much easier to trade, I got back in and bought the Fidelity Wise Origin Bitcoin Fund (FBTC). These riskier investments only make up a small part of my portfolio, with FBTC currently only accounting for 2% of my ETF / index fund investment account. Like with most of my other ETFs in my ETF portfolio, I automatically invest in it weekly.

Bitcoin ETFs Explained

A Bitcoin ETF is like a stock that tracks the price of Bitcoin. Instead of buying Bitcoin directly, which can be complicated, you can buy shares like you would a regular company stock.

Here's the breakdown:

Tracks Bitcoin: FBTC goes up and down in value just like Bitcoin does.

Easier than Bitcoin: No need to set up a digital wallet and wrestle with weird passwords you'll inevitably forget. You can buy shares like you would a regular company stock. People can have exposure to Bitcoin in their retirement accounts.

Not actual Bitcoin: You don't own any actual Bitcoin with FBTC, but you get exposure to its price changes. It’s like your grandma holding onto your allowance – less fun, but safer.

Regulation: Unlike the Wild West of regular crypto, ETFs are overseen by financial authorities.

There are also some disadvantages to buying into a Bitcoin ETF over just owning Bitcoin directly:

Fees: There are management fees associated with ETFs, which eat into your returns.

No direct ownership: With ETFs, you don't directly own Bitcoin (so no bragging rights). You can't transfer it or use it for transactions.

Regulation: While regulation offers some security, it can also lead to restrictions or delays compared to the free-flowing nature of cryptocurrency.

How FBTC has been faring for me

As I mentioned earlier, when you invest in cryptocurrency, you have to be able to handle the swings. I just started buying FBTC in March. At one point, it was up 6%. At another, it was down 14%. This was just in a span of two months. As of this writing, it is down 2%.

My Updated ETF Portfolio

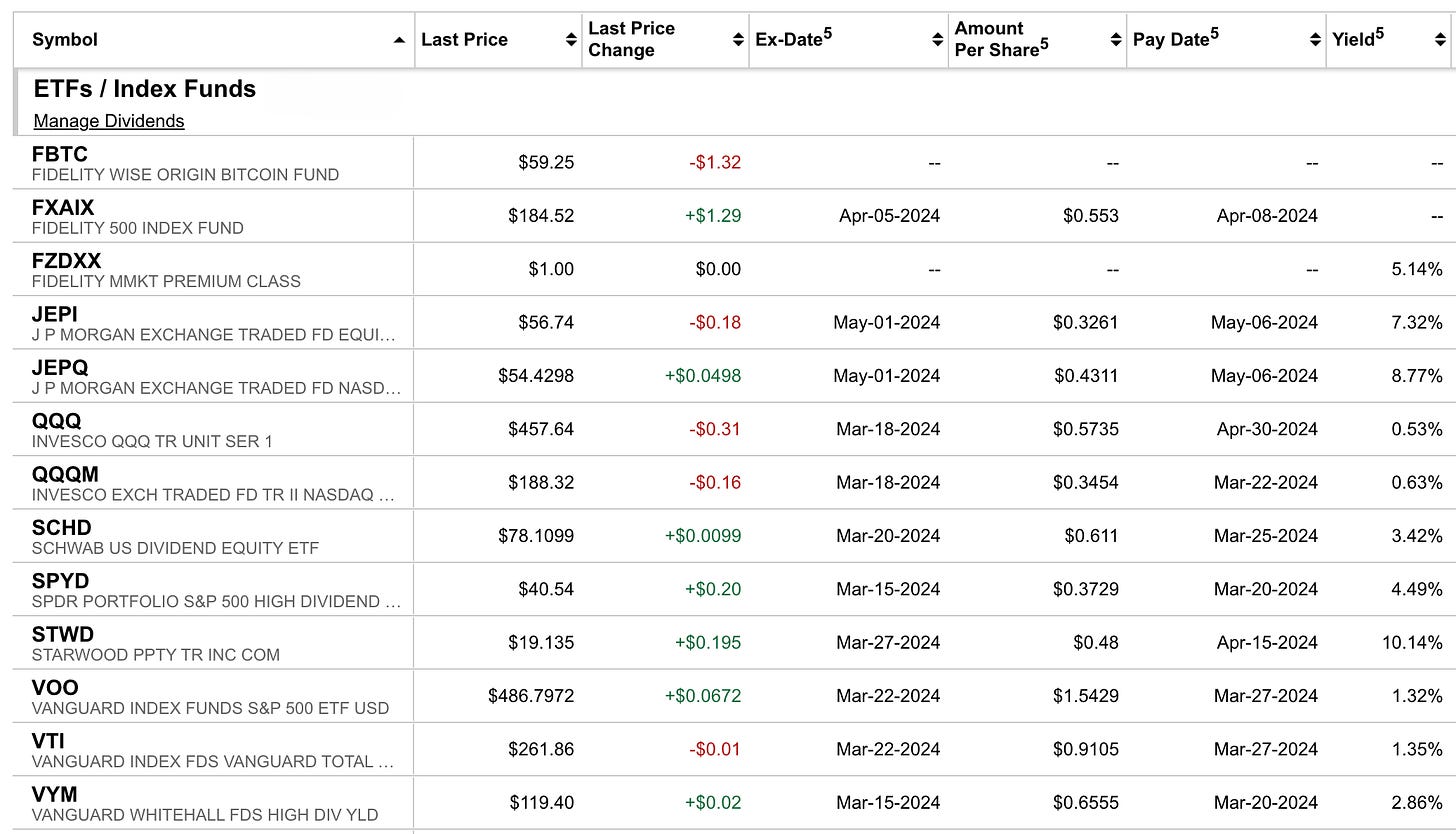

Since I posted my ETF portfolio last September, there have been some changes which include adding FBTC. I mentioned that I had a separate brokerage account for ETF investing with SoFi. I also had a taxable brokerage account with Fidelity which was just for the Fidelity 500 Index Fund (FXAIX) which tracks the S&P 500. Once Fidelity started allowing recurring investments of stocks and ETFs, I closed my SoFi account and combined my ETF / Index Funds into one at Fidelity.

I am semi-retired and the majority of my income comes from dividends and interest from ETFs, stocks, index funds, and fixed-income vehicles like bonds, money market funds, and CDs.

The primary objective of my ETFs / Index Funds account is for passive dividend income along with some growth (with FBTC, QQQ & QQQM). Since my September update, the ETFs I’ve added to my portfolio are QQQM, FBTC (the Bitcoin ETF we discussed), and JEPQ. In all of the funds below (except for QQQ and VTI which I’ll explain below), I have a weekly automatic recurring investment. Below is my updated portfolio and a brief explanation of why I’ve added them:

Invesco NASDAQ 100 ETF (QQQM)

I have owned the Invesco QQQ ETF (QQQ) for years, which aims to track the performance of the NASDAQ-100 Index. Invesco then introduced QQQM in late 2020 which is very similar to QQQ, but has a lower expense ratio (0.15% vs. 0.20% for QQQ). Since the two funds are so similar, I no longer auto-invest in QQQ. If this were a tax-advantaged account like an IRA, HSA, or 401K, I would just sell all of my QQQ and use the proceeds to purchase QQQM. However, this is a taxable account so I would have to pay taxes on the gains, so I’m just letting the QQQ chill in my portfolio like my kids after I’ve told them to walk the dog three times.

JPMorgan Equity Premium Income ETF (JEPQ)

Like with JEPI, JEPQ offers high monthly income through a combination of writing covered calls on stocks they own using equity-linked notes (ELNs), as well as investing in large-cap US companies. All of that is basically a complicated way to say 'high monthly income with low volatility'. While JEPI tracks the S&P 500, JEPQ focuses on a basket of stocks from the Nasdaq-100 index.

Stopping recurring investments in Vanguard Total Stock Market Index Fund ETF (VTI)

Since I combined my ETF and index funds accounts, I stopped my weekly investments in VTI since I already auto-invest in the Fidelity 500 Index Fund (FXAIX), which is very similar. I also auto-invest in the Vanguard S&P 500 ETF (VOO) as a real-world example for this newsletter (I’ll have another VOO update soon, you can see the last one from February here). Like with QQQ, if this were a tax-advantaged account, I’d sell all my VTI and use the proceeds to buy FXAIX. Why have two almost identical things lying around? But since it’s a taxable account, I’m just leaving it.

Conclusion

Once again, I wouldn't recommend Bitcoin to my goldfish. However for me, since I do have a small portion in my portfolio in alternative or riskier investments, it’s like having some Cholula on my financial burrito – adds a little excitement. I’m only investing a small percentage, so if it loses all of its value, it would suck, but I’d be fine. But if it moonshots, it’s front-row seats at WrestleMania in Vegas next year. I currently auto-invest in it, but once it reaches 5% of my ETF / Index Fund account, I’m going to stop and leave it.

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: