Why investing in a 401K can be the easiest investment to make

The first thing to do when you start investing.

Introduction

As an early internet entrepreneur, I founded sites like WrestlingInc.com and IndianDating.com in the late 90s, and FightLine.com in the early 2000s. During that time I consistently invested with the hopes of becoming financially independent before the age of 50, which I fortunately have been able to do.

Throughout my decades of investing, I've had my share of setbacks and successes. I created this newsletter to share those as well as a first-hand look at how I'm investing today. This is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying and where I plan to take those investments.

Please subscribe and help spread the word:

The First Thing To Do Before Starting To Invest

When I was out of college, I had debt with multiple credit cards. Before I could really start to invest, there were several steps that I took first:

Contributed to a 401K plan

Got rid of debt

Cut spending

Created an emergency fund

Created an IRA account

I’ll discuss each of these in detail this week, but Jack Farmer and I discussed this late last year, you can check out that video below:

But in this newsletter I’m going to discuss the first thing I always made sure to do when I would get a new job, and that was to contribute to a 401K plan with employee contributions.

Contribute to your employer-matched 401K

This was always a no-brainer for me. Whenever I’ve had a job with a 401K with employer matching, I signed up immediately. Often an employer will match 5-8%. That is free money. Make sure to contribute at least the full amount that will be matched by your employer.

A 401K account is a company-sponsored retirement account to which employees can contribute income, and employers may match contributions. There are two types: Traditional (where employee contributions are pre-tax but you pay taxes with withdrawals) and ROTH (contributions are made with after-tax income, but withdrawals are tax-free). You can get more details on both at Investopedia.

Until this last year, it had been a while since I’d had a 401K as I had my own corporation and had a SEP-IRA account instead. When I sold Wrestling Inc. last year to Static Media, part of the agreement was that I stayed on for a year as an employee. Static had a 401K plan which I made sure to sign up for immediately and I maxed out my contributions (the maximum contribution to a 401K plan in 2023 is $22,500). Static contributed 50 cents for each dollar for every dollar up to 6% of each contribution.

My Holdings

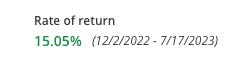

Our 401K plans were moved to Empower last December. Since December 2nd, my rate of return has been over 15% as of today:

As for my holdings, I kept it super basic and all of my contributions were made automatically into Empower’s S&P 500 fund. I do have a little in the “Vanguard Target Retire 2040 Trust Select” fund, but I’m in the process of moving all of that into the S&P 500 fund.

Just a reminder that everyone’s investment goals are different, and this is just how I chose to invest my income. Everyone’s investment goals are different, so always be sure to do your own research.

The Bottom Line

While most of these newsletters will be me just stating what I’m doing and not providing advice, this is one case where I will offer some. If your company offers a 401K plan with employer matching, sign up immediately. Even if you just invest in a money market fund, that employer matching is free money and you likely won’t see that rate of return anywhere. If you’re not sure if your company offers one, contact their HR department immediately and find out. To my surprise via BenefitsPro.com, a lot of people do not contribute to these plans despite it being available:

According to the Department of Labor, however, only 51% of the workforce contributed to an employer-sponsored 401(k) in 2021, despite 68% of private workers having access to a plan.

Conclusion

Please let me know your thoughts on this first newsletter and any feedback. You can follow me on Twitter at @TheRajGiri or on Threads at @RealRajGiri . If you haven’t already, please subscribe below:

I'm not an American but trying to glean whatever I can and see if it's applicable where I live. Anyways, keep up with the good work.

This is great advice. I’m just trying to learn. I have zero experience with this.