Practical Money: Big ROTH IRA and 401K Changes, Mint Is Shutting Down

Changes coming for retirement accounts.

Introduction

As I’ve noted in the past, I am a huge proponent of ROTH IRA and 401K accounts. You can read my newsletter about the benefits of ROTH IRAs here, and how to invest in them even if your income is too high. Also, you can check out my newsletter on 401Ks at this link.

Also, the popular personal finance app Mint is shutting down effective January 1st. I’ve been trying out some alternatives and will provide some feedback below.

A quick reminder that this is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Please subscribe and help spread the word:

Mint Is Shutting Down

The popular budgeting app, Mint, is shutting down effective January 1st. I was recently quoted in a CNBC article about it, where I said, “It’s a big bummer that it’s going away.” And it is. For years, when people have asked me about getting out of debt, I would tell them to start using Mint to set up a budget as a way to get started. I hope that some of the millions of users of Mint don’t stop budgeting because it’s going away.

I personally don’t budget anymore because I have a good idea of how much is coming in and going out every month. But I still have Mint as one of my start pages in Chrome to check all of my accounts daily. Between my wife and I, we have about 60 different financial accounts (which include checking, savings, credit cards, retirement, brokerage, I Bonds, 529s, kids UTMAs, LLCs, etc.) and it was a cinch to check them all out in Mint.

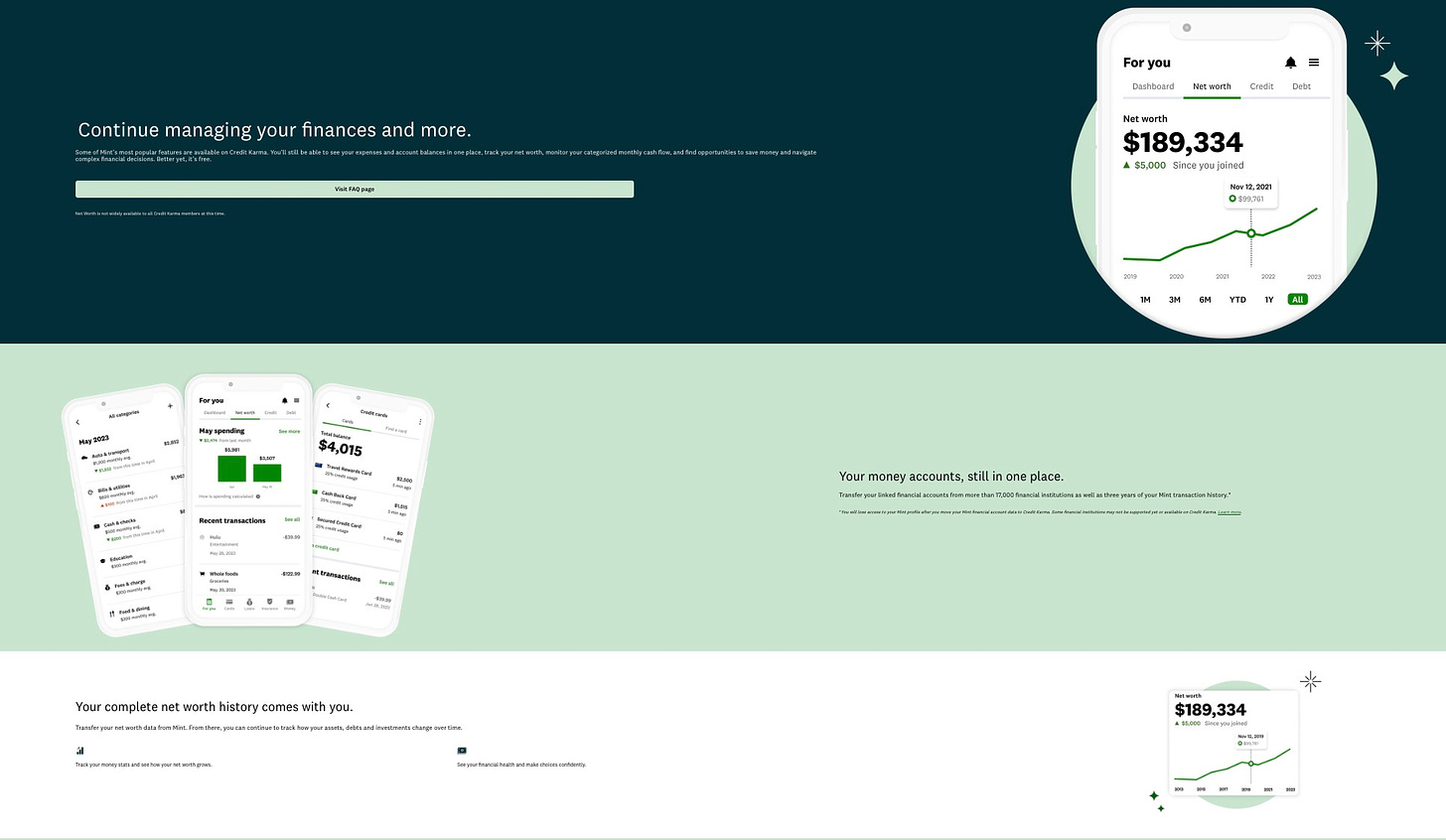

Mint is owned by Intuit (which also owns Credit Karma, Quickbooks, MailChimp, Simplify, and other brands), and their features are moving to Credit Karma. The positive is that you’ll still see expenses and account balances in one place, see your net worth, and more. However, Mint’s current budgeting features will not be available, yet they have stated that they will “continue to evaluate and add features to help you manage your finances and expand those features over time.”

Below is a preview of what the Credit Karma app will look like. I have been testing out some Mint alternatives, and the biggest issue I’ve had so far is that they won’t sync with some of my busier accounts. For instance, Fidelity Full View won’t sync with SoFi, which is where I make weekly automatic contributions to several ETFs. I’m way too lazy to enter those in manually. Empower’s app also won’t link to a couple of my credit cards (as noted before, I HATE credit card debt and pay them all off automatically each month so I never pay any interest), and again, I’m too lazy to enter those in manually.

Ironically, the best solution I’ve found so far is Simplifi, which is owned by Intuit, which owns Mint. I had been using Simplifi as a separate tool for our real estate and LLCs, but now I’ve switched to it being used for all of our accounts. It’s great, however, it’s not free, it is currently $2.99 per month for annual plans or $3.99 per month for monthly plans. There are others like YNAB (You Need A Budget), and EveryDollar, however, I haven’t been able to try those out yet. I’ll have a newsletter next month on those, but for now, Simplifi has been a solid alternative.

IRA and 401K Changes

Before, if you were 49 or younger (which I’m holding onto by a thread), the most you could contribute was $6500. People 50 and over could contribute up to $7,500.

Exciting news! Ok, maybe it’s not that exciting, but it’s news. Starting in 2024, the limit on annual contributions to an IRA for people under 50 increased to $7,000. For people 50 and above, the limit is now $8,000.

It might not sound like a lot, but… before, if you started investing the full $6,500 / year at age 25 in a ROTH IRA, assuming a 10% annual return in an S&P 500 ETF like VOO (which is about what the S&P 500 has averaged over the last century), you would have about $2.3 million at age 65. With the new contribution limit of $7,000, you would have about $3.1 million at age 65.

401K, 403B and (Most) 457 Plan Changes

The contribution limit has also changed for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's Thrift Savings Plan. Before, the limit was $22,500 if you’re under 50. Starting in 2024, that increases to $23,000. I know most people are probably not contributing the full amount, but here are some crazy numbers anyway. IF you were contributing the full $22,500 starting at age 25 in an S&P 500 ETF averaging a 10% annual return, your balance at age 65 would be around $11.9 million. With the increase to $23,000, your balance at age 65 would be $12.1 million. OK, that doesn’t sound like a huge difference, but an extra $200,000 is something I’d take.

For employees 50 and over, the catch-up contribution limit remains $7,500. So with the new limit of of $23,000, you add that $7,500, and the contribution limit is $30,500 for employees 50 and up.

Conclusion

If anything writing this newsletter has taught me is… start investing at age 25! Or sooner! But regardless, the sooner, the better. Please let me know your thoughts on this newsletter and submit any feedback. You can follow me on Twitter at @TheRajGiri or on Threads at @RealRajGiri . If you haven’t already, please subscribe below: