Practical Money: Beat Treasury Yields With Agency And Corporate Bonds

With interest rate cuts looming, agency and corporate bonds might make sense

Introduction

The Federal Reserve is expected to start a series of interest rate cuts at the U.S. central bank’s meeting next week. With these cuts, rates for things like credit cards and mortgage rates will come down. However, it also means lower returns on savings accounts, CDs, and other savings instruments. You’ll already see lower yields for CDs and bonds as the upcoming cuts are already being factored in.

In my last newsletter, I discussed investing in treasury bonds and CDs as part of my fixed-income portfolio. In this newsletter, I’ll discuss investing in agency and corporate bonds, which typically offer higher yields than treasury bonds and CDs.

One important thing to note: most agency and corporate bonds are callable, which means the issuer can redeem them before maturity. Just last week, one of my 5-year agency bonds that was set to mature in 2028 - Federal Home Loan Bank System (FHLB) - was called. I will receive my full initial investment, however, there will be no more interest payments outside of the final partial one I’ll receive this week (I did receive one full interest payment back in June).

A quick reminder that this is not financial advice, just myself sharing my strategies, investments, stocks, index funds, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you found this newsletter helpful, please share it with one friend who might find it useful by using the button below.

Agency Bonds vs. Corporate Bonds

Bonds are debt instruments issued by governments, corporations, or other entities to raise capital. They essentially represent a loan from an investor to the issuer, who promises to repay the principal amount at a specified maturity date and often pay interest periodically. They are considered a lower-risk investment compared to stocks, but even among bonds, risks and returns can vary widely.

Two common types of bonds that I invest in are agency bonds and corporate bonds.

Agency Bonds

Issued by government-sponsored enterprises (GSEs) like Fannie Mae, Freddie Mac, and Ginnie Mae, agency bonds are backed by the U.S. government. This backing provides a strong guarantee of repayment, making them generally considered safer than corporate bonds.

Key characteristics of agency bonds:

Government backing: While most agency bonds are seen as safe, GSE-issued bonds don’t carry the explicit full faith and credit guarantee of the U.S. government like U.S. Treasury bonds. In case of a major financial crisis, they could be at risk. While not as risk-free as U.S. Treasury bonds, they are considered safer than most corporate bonds.

Regular Income: Like all bonds, agency bonds provide regular interest payments, making them attractive to income-seeking investors.

Lower interest rates: Agency bonds typically offer lower yields compared to corporate bonds due to their lower risk profile.

Liquidity: Often highly liquid, especially those issued by major GSEs.

Corporate Bonds

Issued by corporations, corporate bonds represent debt obligations of these entities. These bonds typically offer higher yields than government or agency bonds due to their increased risk profile.

Types of Corporate Bonds:

Investment-Grade Bonds: Issued by companies with high credit ratings, these bonds offer lower yields but come with less risk. All the corporate bonds that I’ve purchased fall into this category.

High-Yield (Junk) Bonds: These are issued by companies with lower credit ratings and thus come with a higher risk of default, but they offer much higher yields. I personally have not ever bought a junk bond.

Key characteristics of corporate bonds:

Credit risk: Companies, especially those issuing high-yield bonds, can default on their debt, leading to loss of principal.

Higher interest rates: Generally offer higher yields than agency bonds to compensate for the increased credit risk.

Interest Rate Risk: As with agency bonds, rising interest rates can reduce the value of existing corporate bonds.

Diverse Options: With corporate bonds, investors can choose from a wide range of industries, allowing for sector-specific investments.

Liquidity: Can vary widely depending on the issuer's size, credit rating, and market conditions.

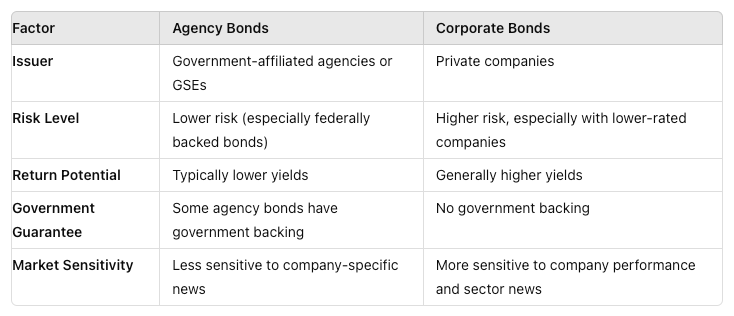

Choosing Between Agency and Corporate Bonds

Deciding whether to invest in agency or corporate bonds depends on a person’s investment goals and risk tolerance.

Risk-averse investors: May prefer agency bonds for their lower credit risk and potential for stable returns.

Risk-tolerant investors: May be drawn to corporate bonds for their higher yields and potential for greater capital appreciation.

Important Considerations

Credit rating: A bond's credit rating, assigned by agencies like Moody's and S&P Global, indicates its creditworthiness. Higher-rated bonds generally have lower yields.

Maturity: The length of time until the bond matures affects its price sensitivity to interest rate changes. Longer-maturity bonds are typically more sensitive.

Below are things to consider when deciding to invest in Agency or Corporate bonds:

My Fixed Income Portfolio

Once again, here is my fixed income portfolio that I posted in the last newsletter. While the treasury bonds and CDs have rates ranging from 4-5.3%, the agency bonds range from 5.4%-6%, while the corporate bond yields range from 6-7.1%.

January: 3-Year Treasury Note

February: 20-Year Treasury Bond

March: A mix of 7-year Treasury Notes, 5-year CDs, and a 15-year Agency Bond

April: 7-Year Treasury Note

May: 20-Year Treasury Bond

June: 5-Year CD

July: A mix of two 5-year CDs and a 15-year Agency Bond

August: One 20-Year Treasury Bond and one 5-Year CD

September: 5-Year CD

October: 1-Year CD maturing in October. I plan to buy a longer-term CD or bond after it matures.

November: 20-Year Treasury Bond

December: A mix of a 3-year Treasury Note, 5-year corporate bonds, 5-year agency bonds, and CDs with ranging maturities. As noted, one of my 5-year agency bonds was called last week.

Conclusion

Both agency and corporate bonds can play a role in building a well-rounded portfolio. Understanding the balance between risk and return is key to leveraging these instruments effectively. Agency bonds may offer security and a modest income stream, while corporate bonds could present opportunities for higher returns, albeit with greater risks. Instead of choosing between the two, I invest in both.

That’s it for this week! Just a reminder that no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

If you haven’t already, please subscribe to this newsletter below and never miss an update: