My Top 5 High-Yielding Savings Accounts

A look at savings accounts yielding as high as over 5%.

Introduction

With interest rates rapidly rising since March of 2022, savings account yields are now the highest in about 15 years.

I personally keep most of my free cash in money market funds, Treasury Bonds, and CDs (which I will discuss more in-depth in future newsletters). However, I do keep a couple of savings accounts: one for any excess income from our rental properties, and the other which serves as both an emergency fund (where I keep six months of savings in case of an emergency to cover living expenses like housing, food, utilities, etc.) and for high expense purchases like vacations.

Below I'm ranking five savings accounts that I’m either currently using or that I’ve used in the last year, as well as their interest rates as of August 29, 2023. All these accounts are FDIC-insured.

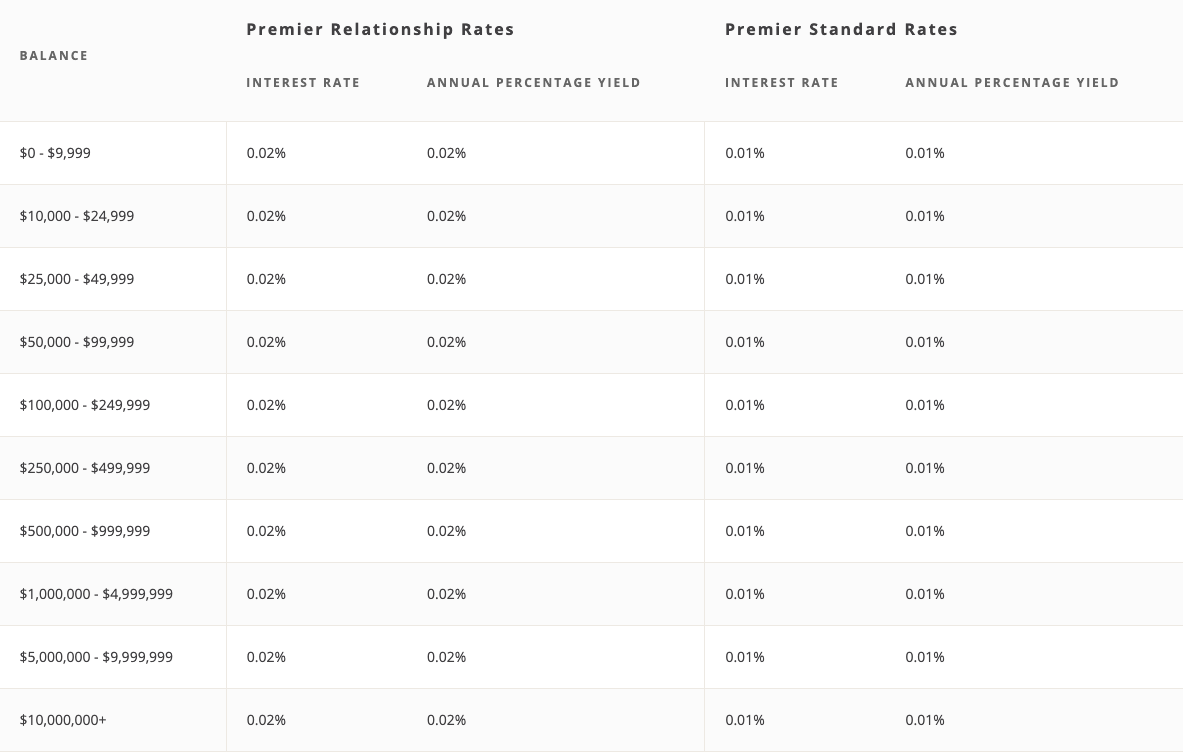

Right now if you look at a large bank like CHASE, they are offering a 0.02% APY for their Premier Relationship Savings account, even if a person has over $10 million in the account.

My main savings account listed below, CIT Savings, is currently offering 5.05% APY with a balance of $5,000 or more. If a person were to invest $10,000 into a CHASE savings account with a 0.02% APY, at the end of the year they would end up with $10,020, having earned $20 in interest. If that same person had an account with CIT Savings, they would end up with $10,517, earning $517 in interest. That’s a difference of almost $500 without doing any extra work.

As noted, all the banks below are FDIC-insured. The FDIC insures up to $250,000 per account holder in the unlikely event of a bank failure (or $500,000 for joint accounts). So if a married couple opens a joint account with $480,000, and the account grows to $550,000 with compounding interest and there is a bank failure, only $500,000 of that is insured. That’s why I always keep a cushion to make sure I don’t go over the FDIC insurance limit. So for a joint account, I would not let the balance go above the $470,000 - $480,000 mark before transferring funds elsewhere.

As always, this is a quick reminder that this is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments.

Please subscribe and help spread the word. Also, please give this newsletter a “Like” as it helps with the Substack algorithm.

Please note that I have or am currently using all the accounts listed below. I am not sponsored by any of the companies below or receive any affiliate income from the links listed, although there is a referral link for Wealthfront that extends my APY rate.

Savings Accounts I Currently Use

#1 CIT Bank Platinum Savings (Up To 5.05% APY)

The CIT Bank Platinum Savings account is my main savings account and currently has a 5.05% APY on balances of $5,000 or more. For balances under $5000, the APY is only 0.25%. The minimum to open is $100.

One of the great things about this account is that there are no fees for the most part. There are no monthly service fees, no online transfer or ACH fees, and even no overdraft / insufficient funds fees. There are no outgoing domestic wire transfer fees for accounts with a balance of $25,000 or more, although if the balance is under that, there is a $10 fee per wire transfer. There is also a return deposit fee of $10 per item.

One of my favorite things about this account is that there are unlimited withdrawals. Most other accounts I’ve used have a monthly limit. I use this account as my emergency fund, as well as for weekly withdrawals to my SoFi brokerage account (which I use to automatically invest in ETFs) as well as for automatic payments for my high-expense credit card (which is used for travel, any major repairs that pop up, etc.)

You can visit CIT Bank’s official website here.

#2 Wealthfront Cash Account (4.80% APY, 5.30% With Referral Link)

Wealthfront is actually not a bank. What is interesting is that they work with partner banks, so the funds in a Wealthfront Cash Account are FDIC-insured up to $5 million through their partner banks where they sweep the deposits in the account. That is far more than the FDIC insurance for a regular savings account ($250,000 per account holder).

I actually currently have a 5.30% APY here because I’m on a promotional rate for 3 months, after that it drops to 4.80%. So as of this writing, it is my account with the highest yield. I use this account for any excess income from my rental properties, as I like to keep that separate from our other income. They don’t have any account fees and also have unlimited withdrawals and transfers. There is also no minimum balance required to earn the 4.80% interest rate.

You can learn more about WealthFront here. I also have a referral link here that will raise your APY to 5.30% for three months, and it extends my current rate of 5.30% for another three months as well.

Savings Accounts I’ve Used In The Past

Below are three accounts I’ve used in the past that I still have open, just with little or no balance. I keep them around in case the interest rates in my other accounts drop below them.

SoFi Bank (Up To 4.5% APY)

SoFi Bank was my main savings account until earlier this year. They offer a 4.5% APY with direct deposit or if you have $5,000 or more in qualifying deposits, otherwise the APY is 1.2%. You can get more details on what qualifies as a qualifying deposit or direct deposit on their official site at this link. There are no overdraft fees, no minimum balance fees, and no monthly fees. I still keep this account open, however, I don’t currently have a balance there.

American Express High Yield Savings (4.25% APY)

Another great savings account that was my main account for years. Over the years, they have consistently had one of the highest interest rates available. They have no minimum balance to receive the 4.25% APY and there is no monthly fee. They also allow up to nine withdrawals and transfers out of the account per month. I still keep this account open, however, I don’t currently have a balance there. You can get more details here.

Citi Accelerate Savings Account (4.25% APY)

Another great savings account with a high rate, however, it is the only one that has a $4.50 monthly fee which is waived if you have a $500+ monthly balance, a relationship tier, or a Citi checking account. I keep the $500 monthly balance in this account to avoid the fee, but I might be closing this account soon. You can get more details at this link.

Conclusion

Changing banks sounds like a pain, but it’s usually not as painful as people think. Usually it can be all done online in 20 minutes or less. I’ve always found it was worth it to take some time out of the day to make the change if there is a significant yield difference. As noted in the example at the top with CHASE and CIT Savings, making the time to change can have a significant impact in your interest income.

Are there accounts you use with a better yield? Have you had experiences with any of the banks listed above? Please let me know in the Comments. Also, please give this newsletter a “Like” as it helps with the Substack algorithm.

Please let me know your thoughts on this newsletter and submit any feedback. You can follow me on Twitter at @TheRajGiri or on Threads at @RealRajGiri . If you haven’t already, please subscribe below: