Introduction

I started this newsletter last year to provide a real-world example of how sticking to basic investing principles over time can pay off. I also started a separate Vanguard S&P 500 ETF (VOO) investment specifically for this newsletter to show exactly how it performs in today’s market. During that time, I’ve revealed my stock investment portfolio, my ETF portfolio, and my fixed income portfolio. In this newsletter, I’ll reveal my IRA account portfolio, which consists of just two ETFs.

A quick reminder that this is not financial advice, just myself sharing my strategies, investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you found this newsletter helpful, please share it with one friend who might find it useful by using the button below.

IRA Account Portfolios: VOO & QQQ

Over the years I’ve had several types of IRA accounts, with SEP-IRAs, Traditional IRAs, and ROTH IRAs.

After years of doing conversions and rollovers, I currently have a Traditional IRA (with no balance, used for ROTH conversions), and a ROTH IRA. Every year I contribute to my Traditional IRA and then do a backdoor conversion for the full amount to my ROTH.

My wife currently has a Traditional IRA and a ROTH IRA. In all of these accounts, we have two ETFs with the same weighting: 50% Vanguard S&P 500 ETF (VOO) and 50% Invesco QQQ Trust (QQQ, which mirrors the Nasdaq 100).

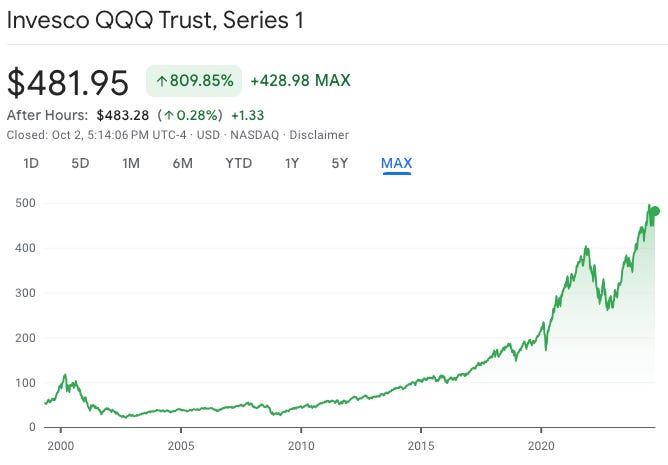

By investing in these two ETFs, half of the portfolio is already matching the market with VOO, since it mirrors the S&P 500 and its long-term average return is typically around 10% annually. However, by having the other half of the account in QQQ, it has historically outperformed the market, especially in periods of rapid tech innovation and adoption. Over the past decade (2013-2023), QQQ has averaged around 18-20% annual returns.

Here’s a quick look at both ETFs.

Vanguard S&P 500 ETF (VOO)

VOO is designed to mirror the performance of the S&P 500, one of the most widely followed indexes in the world. This index consists of the 500 largest publicly traded companies in the U.S. and serves as a benchmark for the overall health of the stock market.

Key Features:

Diversification: VOO provides exposure to a wide range of industries, from tech to healthcare to consumer goods. It’s an excellent choice for those who want broad market exposure.

Lower Risk: Because it holds a wide range of companies, VOO is generally considered less volatile than more concentrated ETFs.

Low Fees: Vanguard is known for offering low-cost ETFs. VOO’s expense ratio is just 0.03%, meaning you keep more of your returns over the long term.

Solid Performance: Historically, the S&P 500 has delivered an average annual return of around 10%, making it a reliable choice for long-term growth.

QQQ (Invesco QQQ Trust)

QQQ tracks the performance of the Nasdaq-100 Index, which is heavily weighted in the technology sector. While this ETF includes some non-tech companies, it’s primarily known for its exposure to tech giants.

Key Features:

Tech Focused: QQQ provides access to leading companies in technology, such as Apple, Microsoft, and Nvidia. As tech continues to drive innovation, QQQ investors benefit from the growth of the sector.

Higher Growth Potential: With its tech-heavy portfolio, QQQ has the potential for higher returns compared to broader market ETFs like VOO, though it comes with higher volatility.

Innovation and Disruption: QQQ includes many companies at the forefront of disruptive technologies such as artificial intelligence, cloud computing, and e-commerce, making it an attractive option for investors seeking exposure to growth sectors.

Competitive Fees: The expense ratio for QQQ is 0.20%, higher than VOO, but still low compared to actively managed funds.

Why Invest In Both

By investing in both VOO and QQQ, I take advantage of two complementary strategies:

VOO for Stability: As a broad market ETF, VOO provides diversification across sectors, helping mitigate risk during market downturns. It’s a foundation for steady, long-term growth.

QQQ for Growth: QQQ’s focus on tech and high-growth companies adds a layer of aggressive growth potential to your portfolio. While it may experience more volatility, its performance has historically outpaced the S&P 500.

Changes In The Future

I’m still in my 40s… barely. As I get closer to retirement, I plan on changing the weighting of these portfolios. Since I already have separate accounts for fixed income and ETFs, I’m not planning to add any bonds or high-dividend ETFs to my IRAs, but I will likely change the mix to 60% VOO / 40% QQQ when I’m in my mid-50s, then 70% VOO / 30% QQQ in my 60s, etc.

For my daughters (ages 13 and 15), I’m doing the opposite. They both have ROTH IRAs with small balances, and those are weighted 70% QQQ / 30% VOO and I hope they update those splits as they get older.

Conclusion

Over time, the combined VOO and QQQ portfolio has consistently outperformed the S&P 500 alone, offering higher long-term returns with moderate added volatility. The key driver of outperformance has been the tech sector's success, captured by QQQ. However, it’s important to remember that this portfolio carries more risk, particularly during periods of tech sector underperformance. While VOO and QQQ can be excellent building blocks for an investment portfolio, it's essential to consider your risk tolerance and investment goals.

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: