Introduction

I’ve been discussing steps to take before investing in non-retirement accounts. In my last post, I discussed getting rid of credit card debt. Once again, here are the five things that I believe are very important before investing in non-retirement accounts:

Cutting spending

Creating an emergency fund

Creating an IRA account

In this post, I’ll discuss cutting spending. Because of how long this post was becoming, I decided to start with the first five steps to cutting spending below, and then the final five in the next newsletter. Coming out of college, I had thousands of dollars of credit card debt and a job that wasn’t paying all that great for the time. Cutting spending was one of the biggest things I had to do to have the extra revenue to pay off that debt. Decades later, I still use most of the strategies below.

In the coming days and weeks, I’ll go over the final two steps above and provide a first-hand look at how I'm investing today. This is not financial advice, just myself sharing my investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments.

Please subscribe and help spread the word:

1. The first step in cutting spending: list expenses and create a budget

The first step I did when I decided to make a concerted effort to cut spending was to list all of the items I was spending money on, whether I was spending on rent, eating out, cable, etc. While reviewing expenses, make a concerted effort to cancel subscriptions and memberships that aren’t being used, like magazines or streaming services you don’t use more than a couple of times per month.

From there, I created a budget and used Microsoft Money to track my expenses. Microsoft Money no longer exists (I’m old), but there are a lot of great budgeting apps out there. I personally have been using Mint, which is a great tool that will automatically keep track of all of your accounts (credit cards, checking, savings, investment, retirement, mortgages, etc.). Best of all, it’s free! You can learn more about it and sign up here (this is not an affiliate link, I receive no revenue if you sign up). Here is a good YouTube video for setting up Mint and creating a budget if you decide to use it.

From there, it’s time to get to the hard part which is cutting spending and possibly making some lifestyle changes. Here are some ways to cut your expenses.

A couple of quick notes:

All of the third-party links are simply my recommendation or what I use, and I do not make any revenue from any links in this post unless otherwise stated.

For all the credit cards that I use, I automatically pay the full statement balance every month so I never pay any interest.

2. Cut down on eating out

This is usually our most significant monthly expense. When I first was trying to get out of debt, this was the hardest step because I was just out of college and my friends liked to go out a lot.

If you eat out every day for lunch, maybe try cutting it down to 2 days a week while bringing your lunch the other days, and then eventually bring your lunch every day. Also, we try to plan out the week with what we’re going to cook and try to make big batches for dinners so we can use leftovers for lunch. Cutting down on eating out will save a lot of money over time.

If you do order food, take the time to pick it up yourself and save money in fees from services like GrubHub and Uber Eats. And if you do eat out, if it's a restaurant or fast food joint you go to often, sign up for their rewards program if they have one, and make sure to collect the points every time you go. I’m a big fan of Jersey Mike’s, and my daughters love Chick-Fil-A, and we end up getting a lot of free meals from their respective rewards programs.

Any time we dine out, or I get fast food, etc. I use the Capital One Savor card, where I earn 4% cash back on dining, entertainment, and streaming services like Netflix, DirecTV Stream, and YouTube Premium. It does have a $95 annual fee, but you can earn a one-time cash bonus if you spend $3,000 on purchases within 3 months of opening the account. There are also free versions of the card that offer 3% cash back on dining. As noted earlier, I automatically pay the full statement balance every month.

3. Buy In Bulk

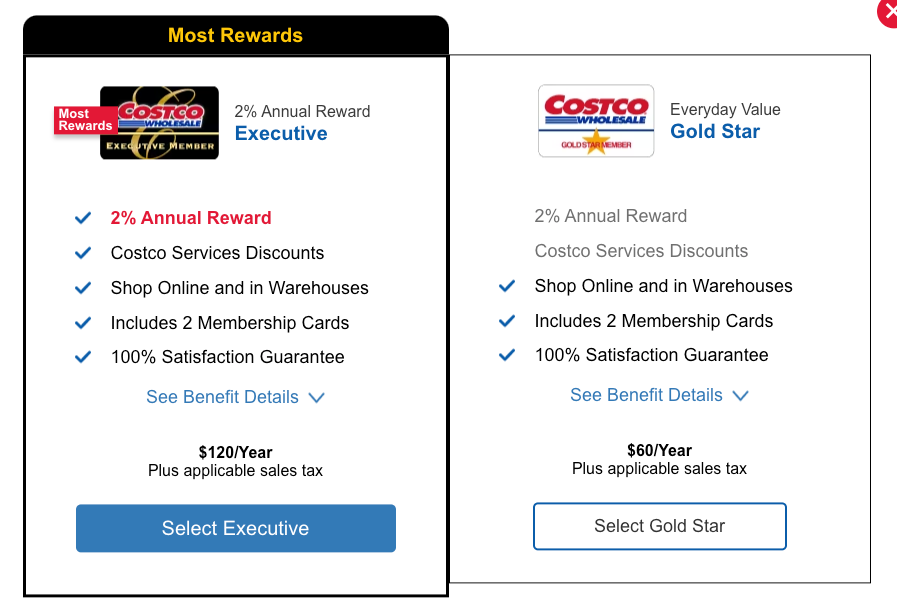

A lot of people shy away from warehouse clubs like Costco or Sam’s Club. But if you use them often, you may save a lot of money in the long run. We have a Costco executive membership and shop there once a month for items like snacks, coffee, wine, organic foods, and paper goods (paper towels, toilet paper, tissues, etc.) A Costco membership costs $60 / year for a general membership, and $120 / year for an executive membership, where you receive additional benefits including 2% cash back. The 2% cash back more than pays for our annual fee each year. Plus we earn an additional 2% cash back using the Citi Double Cash card, which pays 2% cash back on all purchases and has no annual fee. Below is more on the different Costco memberships, you can sign up here.

4. Save money on groceries

With groceries, we plan in advance on what we plan to purchase. My wife and I use the AnyList app where we share our shopping lists (for instance, we have separate lists for Whole Foods, Costco, and our general groceries like Safeway or Krogers / King Soopers) and we try to stay strict on only buying the items on the list to avoid unnecessary purchases. Going to the grocery store when you’re hungry can lead to a lot of fringe purchases, so I’ll often eat a protein bar before going. We also check out our grocer’s website before going shopping for digital coupons, etc., and we register with them to get offers and discounts.

When we purchase groceries from Whole Foods, we use the Amazon Prime card (no annual fee), where we earn 5% on purchases at Whole Foods and Amazon. For other grocery stores, we use the Capital One Savor card noted above, where we earn 3% cash back on groceries (it does not include Costco).

5. Save money shopping

One way to save money shopping is to unsubscribe from promotional emails. Usually, those lead to making unnecessary purchases. When you need to buy something, you can search around for deals.

If you have bigger item purchases, try waiting for major sales events like Black Friday, Cyber Monday, or Amazon Prime Day. Also, you can get great deals by purchasing older versions of items. The Apple Watch SE first generation was selling for $155 at Wal-Mart on Prime Day, while a new one costs $249 at Apple, and there isn’t much of a difference between the two.

One trick that we do to prevent impulse buying (especially for our kids) is to add anything we don’t absolutely need to the shopping cart and leave it there for as long as a week. After that, if we decide we still want it, we’ll buy it. Another thing is that if you’re signed in when you added the items to the cart, and you keep those items in the cart for days, a lot of merchants will email discounts because they want you to complete the purchase.

Finally, sign up for cashback sites. We personally use Rakuten, where you simply go to their site and choose the store you’re looking to buy from (they partner with over 3,500 stores). Rakuten then takes you to the retailer’s site and your cash back is automatically activated. You then receive a check within 15 days of your first purchase and get paid quarterly after that. You can learn more about it and get a $30 bonus here (NOTE: this is an affiliate link).

Conclusion

The next issue will have the final 5 steps for cutting down on spending. Please let me know your thoughts on this newsletter and submit any feedback. You can follow me on Twitter at @TheRajGiri or on Threads at @RealRajGiri . If you haven’t already, please subscribe below: